CashUSA uses several of the most state-of-the-art and you can this new encoding tech to save the member analysis personal and safe. This may involve both the financial and personal guidance away from pages. This site has safeguarded records that folks try not to supply without the right expert. Likewise, it run evaluating on the site several times a day so you can make sure the working platform stays as well as there keeps been zero protection leakage.

Profiles just need to fill in you to application form discover linked to loan providers, even so they get in touch with credible loan providers inside twenty four hours from acceptance. Unlike using old-fashioned banking institutions, when you’re handling CashUSA, the procedure is done almost instantly. Additionally, for folks who deal with a loan render, the cash would be relocated to your Oakwood personal loan lenders bank account inside an effective go out.

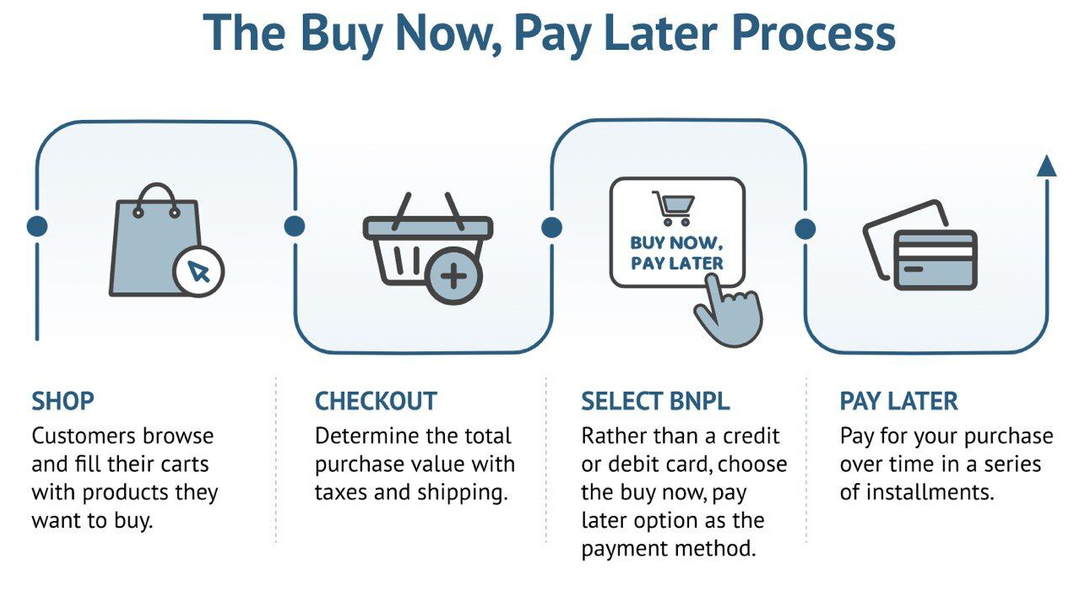

One of the better keeps one kits CashUSA other than almost every other competitors was their cost options and you may liberty. Profiles can make repayments in case it is easier in their mind, either manually on line otherwise using car money. Vehicle repayments make it pages to overlook the mortgage while having CashUSA handle it. At exactly the same time, the working platform will need away financing payment money from this new user’s checking account monthly. So it means borrowers aren’t later for the payments and you may would maybe not default to the financing.

Experts

- Easy-to-play with properties

- More one million pages month-to-month

- Loan payments is actually simple and easy flexible

- Broad circle regarding loan providers

- A lot more educational offered

- Safe program protects all representative information

Cons

- Plenty of information is questioned throughout the software procedure

Analysis

Unsecured loans was an internet program you to definitely strives to add easier and you can secure financing attributes in order to whoever demands him or her. To do this, he has got a variety of loan providers and other financial companies in order to assist anyone score poor credit funds that have secured approvals.

Personal loans pledges their consumers a secure, fast, and you can secure fund import no matter what other variables for example why the cash is needed, the quantity, as well as what big date the money needs.

So it Utah-established team has been around the online lending company to own a great if you’re. Over this time, they have gained brand new believe off 1000s of consumers with simply restaurants things to state on the subject.

No matter the reason for brand new finance, should it be household repair otherwise scientific bills; Personal loans constantly has actually a solution. Their loan application procedure is fast and simple, starting with filling up an online earliest guidance setting on the specialized website.

Immediately after everything is provided and recorded, the shape try circulated one of an enormous system regarding legitimate lenders. In so doing, multiple prospective lenders look at your consult and you can work on your. Which preserves a lot of time and energy since you carry out not need to contact for every financial directly. Once you get the fine print of your poor credit personal bank loan, you really have three choice, often negotiate the latest words, refuse the offer, or accept is as true. There is absolutely no obligation to just accept a loan.

Immediately after things are signed and you can complete, you might have the financing on the given bank account when you look at the less than 1 day.

Shows

If you find yourself dealing with Personal loans, users normally comment also provides off numerous lenders. On the other hand, it get the accessibility to dealing with any business regarding system community otherwise opting for out of a 3rd-cluster financial reported on the site. Thus giving pages the decision to compare different mortgage proposes to pick the best you to definitely.

Unsecured loans works together with lenders you to favor the fresh borrower and make payments. It gives individuals certain leniency and come up with installments and payments.